Embarking on a journey into The 5 Cheapest General Liability Insurance Options for US Startups (2026 Rates, Coverage & Cost Comparison), this introduction aims to pique the interest of readers with a blend of informative insights and engaging details.

The subsequent paragraph will delve deeper into the intricacies of the topic, shedding light on essential aspects for startups to consider.

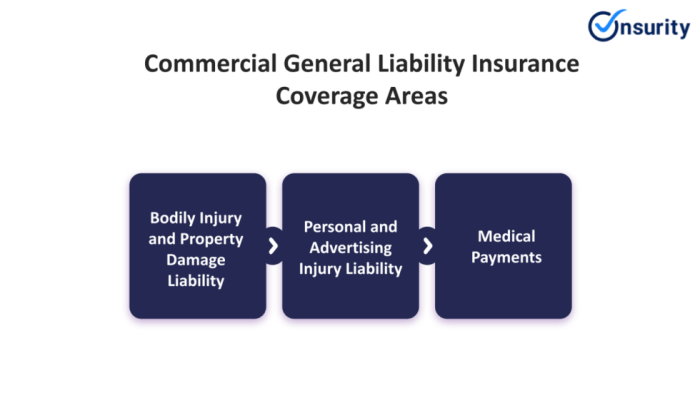

Overview of General Liability Insurance

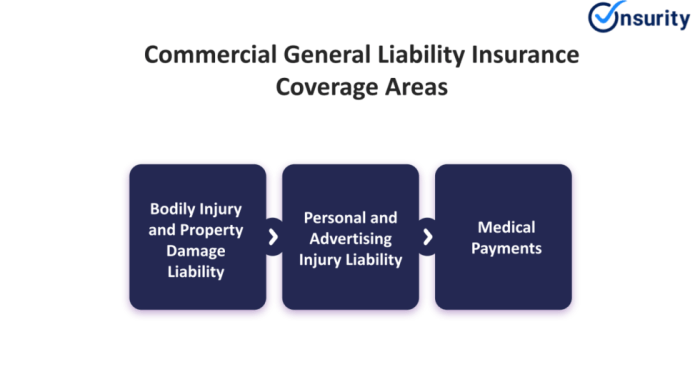

General liability insurance is a type of coverage that protects businesses from financial losses resulting from claims of bodily injury, property damage, and other related incidents. It is designed to cover legal fees, medical expenses, and settlements that may arise from these claims.

Importance of General Liability Insurance for Startups

For startups, general liability insurance is crucial as it provides protection against unforeseen circumstances that could potentially bankrupt the business. It offers peace of mind to entrepreneurs by safeguarding their assets and ensuring financial stability in the face of lawsuits or claims.

Comparison of General Liability Insurance to Other Types of Business Insurance

- General Liability Insurance: Covers third-party claims for bodily injury, property damage, and advertising injury.

- Professional Liability Insurance: Protects against claims of professional negligence, errors, or omissions.

- Commercial Property Insurance: Covers physical assets like buildings, equipment, and inventory against damage or loss.

- Workers' Compensation Insurance: Provides benefits to employees for work-related injuries or illnesses.

Factors Affecting General Liability Insurance Costs

When it comes to general liability insurance costs for startups, several factors come into play. Understanding these factors can help entrepreneurs make informed decisions when purchasing insurance coverage.

Size and Nature of Startup

The size and nature of a startup play a significant role in determining the cost of general liability insurance. Larger startups with more employees, higher revenues, and a larger customer base are generally considered to have a higher risk exposure, leading to higher insurance premiums.

Additionally, startups operating in high-risk industries such as construction or healthcare may face higher insurance costs compared to startups in lower-risk sectors.

Claims History

The claims history of a startup can also impact insurance premiums. Startups with a history of frequent or costly liability claims are viewed as higher risk by insurance providers, leading to higher premiums. On the other hand, startups with a clean claims history and a strong risk management program in place may be eligible for lower insurance rates.

Comparison of the 5 Cheapest General Liability Insurance Options

When looking for the most affordable general liability insurance options for US startups in 2026, it's crucial to compare rates, coverage limits, and exclusions. Understanding the differences between these options can help you make an informed decision that meets your business needs while staying within budget.

Insurance Provider 1

- Rate: $X per month

- Coverage Limit: $X million

- Exclusions: [list of exclusions]

Insurance Provider 2

- Rate: $X per month

- Coverage Limit: $X million

- Exclusions: [list of exclusions]

Insurance Provider 3

- Rate: $X per month

- Coverage Limit: $X million

- Exclusions: [list of exclusions]

Insurance Provider 4

- Rate: $X per month

- Coverage Limit: $X million

- Exclusions: [list of exclusions]

Insurance Provider 5

- Rate: $X per month

- Coverage Limit: $X million

- Exclusions: [list of exclusions]

Tips for Startups to Lower General Liability Insurance Costs

Starting a new business can be costly, but there are ways for startups to lower their general liability insurance costs. By implementing certain strategies and risk management practices, startups can effectively reduce their premiums and save money in the long run.One effective way for startups to lower general liability insurance costs is by focusing on risk management.

By identifying and addressing potential risks within the business, startups can demonstrate to insurance providers that they are proactive in preventing claims. This can lead to lower premiums as insurers see the business as less risky to insure.

Implementing Risk Management Strategies

Implementing risk management strategies is key to lowering general liability insurance costs for startups. By conducting regular risk assessments, businesses can identify areas of potential exposure and take steps to mitigate these risks. This can include implementing safety protocols, providing employee training, and ensuring proper documentation of policies and procedures.

- Regularly review and update safety protocols

- Invest in employee training programs

- Create a thorough incident reporting and documentation process

- Implement a crisis management plan

Bundling Insurance Policies for Cost Savings

Another way for startups to lower general liability insurance costs is by bundling insurance policies. By purchasing multiple types of insurance from the same provider, startups can often receive a discount on their premiums. This can include bundling general liability insurance with property insurance, workers' compensation, or cyber liability insurance.

- Explore bundling options with insurance providers

- Consider the specific needs of the business when bundling policies

- Compare quotes from different providers to ensure cost-effectiveness

- Review the coverage limits and exclusions of bundled policies carefully

Understanding Coverage Options and Requirements for US Startups

When it comes to general liability insurance for startups in the US, it is essential to understand the basic coverage options required and the specific requirements based on industry standards.

Basic Coverage Options for US Startups

- General Liability Insurance: This coverage protects businesses from third-party claims of bodily injury, property damage, and advertising injury.

- Property Insurance: Covers physical assets such as buildings, equipment, and inventory against damage or loss.

- Professional Liability Insurance: Also known as errors and omissions insurance, it protects against claims of negligence or inadequate work.

Difference Between Occurrence-based and Claims-made Policies

Occurrence-based policies cover claims made for incidents that occurred during the policy period, even if the claim is filed after the policy expires. Claims-made policies, on the other hand, only cover claims made while the policy is active.

Specific Coverage Requirements for Startups in Certain Industries

| Industry | Specific Coverage Requirement |

|---|---|

| Tech Startups | Cyber Liability Insurance to protect against data breaches and cyberattacks. |

| Healthcare Startups | Medical Malpractice Insurance to cover claims of negligence or errors in medical treatment. |

| Construction Startups | Contractor's Liability Insurance to protect against property damage or injuries on construction sites. |

Concluding Remarks

Concluding our discussion on a high note, this summary paragraph encapsulates the key points discussed, leaving readers with a lasting impression of the importance of general liability insurance for startups.

Question Bank

What factors influence the cost of general liability insurance?

Factors such as the size and nature of the startup, claims history, and coverage limits can impact insurance costs.

What are the basic coverage options required for US startups?

Basic coverage options may include general liability, property insurance, and workers' compensation, among others.

What is the difference between occurrence-based and claims-made policies?

Occurrence-based policies cover claims that occur during the policy period, while claims-made policies cover claims made during the policy period regardless of when the incident occurred.