Exploring Contractor Savings: US State-by-State Workers’ Comp Premiums (2026 Rates Ranked Lowest to Highest) delves into the intricate world of workers’ compensation premiums, unveiling key insights on how contractors can optimize savings in this dynamic landscape.

The following paragraphs offer a detailed breakdown of factors influencing premiums, a comparison of state-by-state rates, strategies for cost reduction, and more.

Introduction to Workers’ Comp Premiums

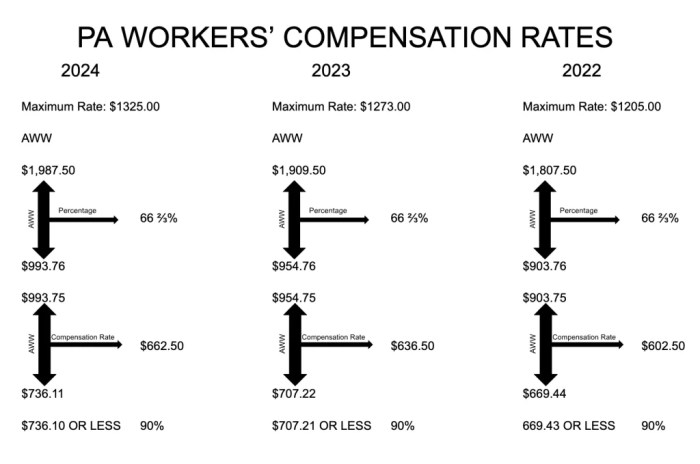

Workers’ compensation premiums are the costs that employers pay to provide insurance coverage for employees who may suffer work-related injuries or illnesses. These premiums are essential for protecting both workers and employers in case of accidents on the job.State-by-state variations in workers’ comp premiums are significant as each state has its own set of regulations, laws, and insurance market conditions that impact the cost of coverage.

Factors such as industry type, company size, and claims history also influence the premiums paid by contractors.Contractors can save on workers’ comp premiums by implementing safety measures to reduce workplace accidents, properly classifying employees based on job duties, and shopping around for competitive insurance rates.

Understanding the state-specific regulations and requirements can also help contractors optimize their coverage and minimize costs.

Factors Influencing Workers’ Comp Premiums

Workers’ comp premiums are influenced by several key factors that impact the costs for businesses. Understanding these factors can help employers make informed decisions to manage their premium rates effectively.

Industry Type Impact on Premium Rates

Different industries have varying levels of risk associated with workplace injuries, which directly affects workers’ comp premiums. Industries with higher rates of injuries and claims will generally have higher premium costs compared to industries with lower risk levels. For example, construction and manufacturing industries typically have higher premiums due to the physical nature of the work and increased likelihood of accidents.

Safety Measures and Premium Costs

Implementing effective safety measures in the workplace can help reduce the number of accidents and injuries, ultimately leading to lower workers’ comp premiums. Employers who prioritize safety training, provide proper safety equipment, and maintain a safe work environment are likely to see lower premium costs.

Safety measures not only protect employees but also benefit the business financially by reducing the frequency and severity of workplace injuries.

US State-by-State Comparison of Workers’ Comp Premiums

In the United States, workers' compensation premiums can vary significantly from state to state. These variations are influenced by a variety of factors, including state regulations, industry practices, and the overall health of the state's economy. Understanding these differences is crucial for both employers and employees to navigate the complexities of workers' comp insurance.

Top 5 States with the Lowest Workers’ Comp Premiums

- 1. North Dakota

- 2. Indiana

- 3. Arkansas

- 4. Mississippi

- 5. West Virginia

The ranking of states based on workers' comp premiums is crucial for businesses looking to expand or relocate, as lower premiums can significantly impact the overall cost of doing business. States with lower premiums often have more competitive markets, which can benefit both employers and employees in terms of cost savings and coverage options.The reasons behind variations in workers' comp premiums across different states can be attributed to a variety of factors, including state regulations, the overall health of the state's economy, the industry mix within the state, and the historical performance of the state's workers' comp system.

States with lower premiums may have more favorable regulatory environments, lower claim frequencies, or more efficient claims processes, all of which can contribute to reduced costs for employers.It is essential for businesses to carefully consider these factors when evaluating workers' comp insurance options and to stay informed about changes in regulations or market conditions that may impact premiums in the future.

Strategies for Saving on Workers’ Comp Premiums

When it comes to reducing workers' comp costs for contractors, implementing effective strategies is key to saving money in the long run. By focusing on risk management and forming partnerships with insurance providers, contractors can lower their premiums and protect their bottom line.

Implementing Risk Management Practices

Risk management plays a crucial role in lowering workers' comp premiums. By prioritizing workplace safety, providing proper training to employees, and identifying potential hazards, contractors can minimize the risk of accidents and injuries. This proactive approach not only creates a safer work environment but also demonstrates to insurance providers that the business is committed to reducing claims, which can lead to lower premiums.

Partnering with Insurance Providers

Collaborating with insurance providers can also result in significant savings on workers' comp premiums. By working closely with insurers to assess risks, develop safety programs, and implement loss control measures, contractors can show their dedication to preventing workplace injuries. Insurance companies may offer discounts or incentives for proactive risk management practices, ultimately reducing the overall cost of coverage for contractors.

Outcome Summary

In conclusion, Contractor Savings: US State-by-State Workers’ Comp Premiums (2026 Rates Ranked Lowest to Highest) sheds light on the nuances of premium variations, empowering contractors with valuable knowledge to make informed decisions and maximize savings.

Key Questions Answered

What are workers’ compensation premiums?

Workers’ compensation premiums are fees paid by employers to insurance companies to provide benefits to employees who are injured or become ill due to work-related incidents.

How can contractors save on workers’ comp premiums?

Contractors can save on workers’ comp premiums by implementing safety measures, partnering with insurance providers, and prioritizing risk management practices.

Why do workers’ comp premiums vary by state?

Workers’ comp premiums vary by state due to factors such as state regulations, industry type, safety records, and overall claim history.