Embark on a journey to explore how to collaborate with the top M&A advisory firms in NYC for a successful 2026 exit. This guide delves into key aspects like fees, deal size, and the overall process, offering valuable insights for a seamless partnership.

Providing in-depth details on each step, this guide equips you with the knowledge needed to navigate the intricate world of M&A transactions with confidence and expertise.

Researching Top M&A Advisory Firms in NYC

When looking to partner with the top M&A advisory firms in NYC for a 2026 exit, it is crucial to conduct thorough research to ensure you choose the right firm for your needs. This involves identifying the top 5 M&A advisory firms specializing in exits, comparing their reputation, track record, and client reviews, and understanding the criteria for selecting the top firms based on expertise and industry focus.

Identifying the Top 5 M&A Advisory Firms

To begin your research, you should first identify the top 5 M&A advisory firms in NYC that specialize in exits. Look for firms that have a strong reputation in the industry and a track record of successful deals. Consider reaching out to industry experts, reading industry publications, and exploring online resources to compile a list of potential firms.

Comparing Reputation, Track Record, and Client Reviews

Once you have identified potential firms, it is important to compare their reputation, track record, and client reviews. Look for firms that have a history of successfully guiding clients through exit processes and have positive feedback from previous clients. Consider factors such as deal size, industry expertise, and overall client satisfaction when evaluating each firm.

Criteria for Selecting Top Firms

When selecting the top firms for your 2026 exit, consider criteria such as expertise and industry focus. Look for firms that have experience in your specific industry and have a deep understanding of the market dynamics that may impact your exit strategy.

Additionally, consider the firm's expertise in negotiating deals, structuring transactions, and navigating complex regulatory environments to ensure a successful exit process.

Understanding Fee Structures

In the world of M&A advisory firms, understanding fee structures is crucial when planning an exit transaction. Let's dive into the typical fee structures and how they can vary based on the complexity and size of the deal.

Types of Fee Models

- Retainer Fees: Some M&A advisory firms charge a retainer fee upfront to secure their services and cover initial costs. This fee is typically a fixed amount agreed upon before the start of the engagement.

- Success Fees: Success fees are a percentage of the total deal value that the advisory firm receives upon successful completion of the transaction. This incentivizes the firm to work towards achieving the best possible outcome for their client.

- Expense Reimbursements: In addition to the retainer and success fees, M&A advisory firms may also bill clients for out-of-pocket expenses incurred during the deal process, such as travel expenses, legal fees, or due diligence costs.

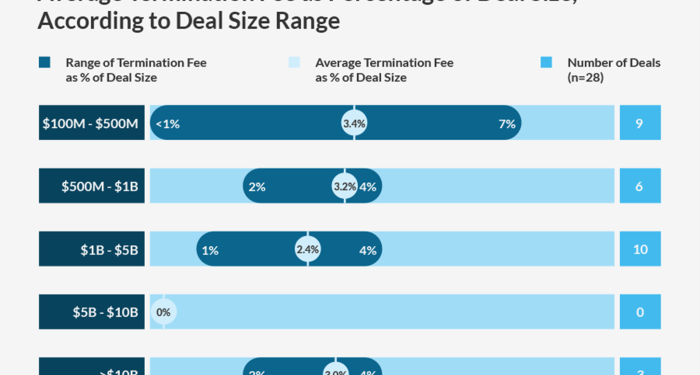

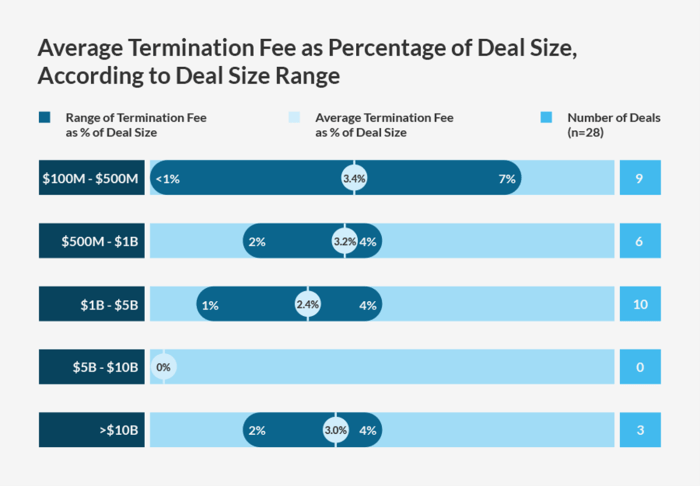

Variability Based on Deal Complexity and Size

When it comes to fee structures, complexity and deal size play a significant role in determining the overall cost of engaging an M&A advisory firm. More complex deals that require extensive due diligence, negotiations, and strategic planning are likely to incur higher fees compared to smaller, straightforward transactions.

Similarly, larger deal sizes often result in higher success fees due to the increased value being transacted.

Evaluating Deal Size and Complexity

When considering M&A advisory firms in NYC, it is crucial to evaluate the deal size and complexity they typically handle. This information can give insight into their capabilities and expertise in managing various types of transactions.

Average Deal Size Handled

- Company A typically manages deals ranging from $100 million to $500 million, focusing on mid-market transactions.

- Company B specializes in mega-deals exceeding $1 billion, catering to large corporations and private equity firms.

- Company C has a diverse portfolio, handling deals of all sizes, from small acquisitions to multi-billion dollar transactions.

- Company D focuses on middle-market deals, with an average size of $250 million to $1 billion.

- Company E is known for its expertise in cross-border transactions, managing deals of varying sizes depending on the international scope.

Factors Determining Complexity

- The industry in which the target company operates can significantly impact the complexity of the deal, with regulated industries requiring more due diligence.

- The number of stakeholders involved, such as shareholders, board members, and regulatory bodies, can increase the complexity of negotiations.

- Geographic considerations, including international operations or cross-border transactions, add another layer of complexity to M&A deals.

Approach to Handling Deals

- Company A focuses on providing tailored solutions for each deal, adapting their approach based on the specific size and complexity of the transaction.

- Company B leverages its extensive network and resources to manage large-scale deals efficiently, ensuring a smooth process for all parties involved.

- Company C adopts a flexible approach, capable of handling deals of all sizes and complexities with a customized strategy for each transaction.

- Company D emphasizes thorough due diligence and strategic planning to navigate the complexities of middle-market transactions effectively.

- Company E excels in cross-border deals, offering specialized expertise in navigating the unique challenges associated with international M&A transactions.

Navigating the M&A Advisory Process

When considering partnering with an M&A advisory firm for your exit strategy, understanding the typical steps involved in the M&A process is crucial. From initial engagement to deal closure, the M&A advisor plays a pivotal role in guiding you through each stage with expertise and precision.

Overview of the M&A Process

- Engagement: The process begins with the selection of an M&A advisory firm, followed by the signing of an engagement letter outlining the terms of the engagement.

- Due Diligence: The M&A advisor conducts thorough due diligence to assess the financial, legal, and operational aspects of the business to identify potential risks and opportunities.

- Valuation: The advisor helps determine the valuation of the business, considering various factors such as market conditions, financial performance, and industry trends.

- Deal Structuring: Collaborating with the client, the M&A advisor assists in structuring the deal to maximize value and achieve the desired outcome.

- Negotiations: The advisor facilitates negotiations between the parties involved to reach a mutually beneficial agreement that satisfies both buyer and seller.

- Regulatory Compliance: Ensuring compliance with legal and regulatory requirements is a crucial aspect of the M&A process, and the advisor plays a key role in navigating these complexities.

- Deal Closure: The M&A advisor guides the transaction to closure, ensuring all necessary documentation is in place and facilitating a smooth transition for both parties.

Building Relationships with Advisory Firms

Building strong relationships with top M&A advisory firms in NYC is crucial for a successful exit strategy. By establishing connections, building rapport, and fostering trust with advisors, you can ensure a smooth and efficient process towards achieving your goals.

Strategies for Establishing Connections

- Attend industry events and networking opportunities where advisory firms are present.

- Utilize referrals from trusted sources within your industry to get introductions to key players.

- Engage with advisory firms on social media platforms to start conversations and showcase your interest in partnering with them.

Importance of Building Rapport and Trust

Building rapport and trust with advisors is essential as it lays the foundation for a successful partnership. Clear communication, transparency, and mutual respect are key components in fostering a strong working relationship.

Networking Opportunities and Industry Events

Industry events such as conferences, seminars, and workshops provide an ideal platform to engage with potential advisory partners. Make the most of these opportunities to interact with industry professionals, showcase your business, and express your interest in working together.

Closing Notes

In conclusion, partnering with top M&A advisory firms in NYC for a 2026 exit involves a strategic approach focusing on fees, deal size, and the overall process. By understanding these crucial elements, you can forge strong partnerships and achieve successful exits in the dynamic M&A landscape.

Clarifying Questions

What are some common fee structures used by M&A advisory firms in NYC?

Typical fee structures include retainer fees, success fees, and expense reimbursements, which can vary based on the complexity and size of the deal.

How can I determine the complexity of an M&A deal when evaluating advisory firms?

Factors like deal size, industry regulations, and the number of stakeholders involved can help gauge the complexity of an M&A transaction.

What steps are typically involved in the M&A advisory process for an exit?

The process usually includes initial engagement, due diligence, negotiation facilitation, and regulatory compliance leading up to deal closure.