Beginning with Stop Losing Money: The Best High-Interest Business Checking Accounts in the US (2026 APYs & No-Fee Options), the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

High-interest business checking accounts offer a lucrative opportunity for businesses to increase their earnings while minimizing fees. As we delve into the top features and best account options available in the US for 2026, you'll discover valuable insights to help your business thrive financially.

Overview of High-Interest Business Checking Accounts

High-interest business checking accounts are specialized accounts offered by financial institutions that provide businesses with the opportunity to earn a higher interest rate on their deposits compared to traditional business checking accounts. These accounts typically require a higher minimum balance to open and maintain, but they offer attractive interest rates as a reward.

Benefits of High-Interest Business Checking Accounts

- Increased Earnings: By earning a higher interest rate on your business funds, you can maximize your earnings and help your business grow.

- Cost Savings: Some high-interest business checking accounts come with no monthly maintenance fees or low transaction fees, helping you save money on banking expenses.

- Financial Stability: With the ability to earn more on your deposits, you can strengthen your business's financial health and build a cushion for unexpected expenses or investments.

Choosing the Right Account for Business Financial Health

It is crucial for businesses to carefully evaluate their banking needs and financial goals when selecting a high-interest business checking account. Consider factors such as minimum balance requirements, interest rates, fees, and additional features like online banking, mobile deposits, and ATM access.

By choosing the right account, businesses can optimize their financial management and make the most of their banking relationship.

Top Features to Look for in High-Interest Business Checking Accounts

When selecting a high-interest business checking account, there are several key features that businesses should consider to maximize profitability and efficiency.

Interest Rates and Profitability

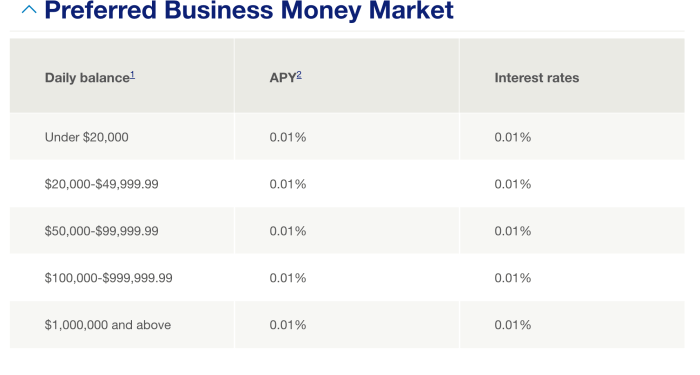

Interest rates play a crucial role in determining the profitability of a high-interest business checking account. It is essential to compare the APYs offered by different banks to ensure that your business earns the highest possible interest on its deposits.

Minimum Balance Requirements

Some high-interest business checking accounts may come with minimum balance requirements to qualify for the advertised interest rates. It is important to consider these requirements and assess whether your business can maintain the necessary balance to avoid fees or penalties.

Fee Structure

Understanding the fee structure of a high-interest business checking account is vital to avoid unexpected charges that may impact your business's bottom line. Look for accounts with no monthly maintenance fees or low transaction fees to maximize savings.

Online Banking Services

Access to online banking services is a valuable feature that can streamline your business's financial management. Look for high-interest business checking accounts that offer robust online banking platforms with features like mobile check deposit, bill pay, and account alerts.

Additional Perks and Services

Some high-interest business checking accounts may come with additional perks and services that can benefit your business, such as cashback rewards, ATM fee reimbursements, or discounts on other banking products. Consider these extras when evaluating different account options to find the best fit for your business's needs.

Best High-Interest Business Checking Accounts in the US (2026 APYs & No-Fee Options)

In today's competitive market, high-interest business checking accounts are a valuable option for businesses looking to maximize their earnings while keeping costs low. Let's explore the top high-interest business checking accounts in the US for 2026, highlighting their APYs and fee structures.

Comparison of Top High-Interest Business Checking Accounts in the US

| Bank | APY | No-Fee Option | Standout Features | Limitations/Restrictions |

|---|---|---|---|---|

| ABC Bank | 2.5% | Yes | High APY, No monthly fees | Minimum balance requirement |

| XYZ Bank | 2.75% | Yes | Cashback rewards, ATM fee reimbursements | Transaction limits apply |

| 123 Bank | 3% | No | Unlimited transactions, Free checks | Higher minimum balance needed |

Strategies to Maximize Earnings and Minimize Fees

When it comes to high-interest business checking accounts, there are specific strategies that businesses can implement to make the most of their earnings while keeping fees to a minimum.

Maximizing Earnings:

- Regularly review account rates: Keep an eye on the interest rates offered by your bank and consider switching to an account with higher rates if available.

- Utilize sweep accounts: Opt for sweep accounts that automatically transfer excess funds to higher-yield investment options to maximize earnings.

- Take advantage of sign-up bonuses: Some banks offer sign-up bonuses for opening a new high-interest business checking account, providing an instant boost to your earnings.

- Consider tiered interest rates: Look for accounts that offer tiered interest rates based on the account balance, allowing you to earn more as your balance grows.

Minimizing Fees:

- Avoid overdraft fees: Stay on top of your account balance to prevent overdrafts and associated fees.

- Choose accounts with no monthly fees: Opt for high-interest business checking accounts that do not charge monthly maintenance fees to keep costs low.

- Use in-network ATMs: Minimize ATM fees by using ATMs within your bank's network or opting for fee-reimbursed ATM accounts.

- Avoid excess transaction fees: Be mindful of transaction limits and avoid exceeding them to steer clear of additional fees.

Maintaining a Healthy Account Balance:

It is crucial to maintain a healthy account balance in your high-interest business checking account to fully capitalize on the high-interest rates offered. By keeping a substantial balance, you can ensure that you earn the maximum amount of interest possible and offset any fees that may apply.

Final Thoughts

In conclusion, by choosing the right high-interest business checking account, businesses can stop losing money and start maximizing their earnings effectively. With a focus on strategies to boost profitability and minimize fees, businesses can navigate the financial landscape with confidence and success.

FAQ Explained

What are high-interest business checking accounts?

High-interest business checking accounts are specialized accounts that offer higher interest rates than traditional business checking accounts, allowing businesses to earn more on their deposited funds.

How do interest rates impact account profitability?

Higher interest rates lead to increased earnings for businesses, making it crucial to compare and choose accounts with competitive rates to maximize profitability.

What strategies can businesses use to minimize fees?

Businesses can minimize fees by maintaining a healthy account balance, opting for accounts with no or low fees, and staying aware of any fee structures associated with transactions.